දිනපතා සත්ය කරුණු දැන ගැනීමට අපගේ WhatsApp සමුහයටමෙතනින් එකතුවන්න.

Sri Lanka is currently grappling with ways to overcome its worst economic crisis since gaining independence in 1948. This has prompted the government to increase state revenue through various measures, one such being raising the Value Added Tax (VAT) to 18% from the existing 15%.

However, misleading social media posts have emerged, particularly regarding the impact of this tax hike on the digital and telecommunication industry. Our investigation aims to clarify the situation by separating fact from fiction and providing an accurate assessment of the actual implications of the VAT increase for these sectors.

Social Media Posts

Social media posts assert that data and voice charges for Sri Lanka’s communication networks have been increased by 23% starting from January 1, 2024, while television charges have been increased by 42%

Users commented to it like below.

A web article linked with this can be read here

We decided to do a fact-check on this.

Fact Check:

Gazette Notification 2363/22: The claim does reference a Gazette notification (2363/22) dated December 19, according to which the Value Added Tax (VAT) was increased by 3%, not 42%. A Gazette notification can be read here.

Verification of Telecommunication Service Providers’ Notifications:

Our investigation involved checking notifications from various telecommunication service providers in Sri Lanka. Contrary to the social media claim, the actual increment in charges reported by these providers was not 42% but approximately 3%, corresponding to the VAT increase.

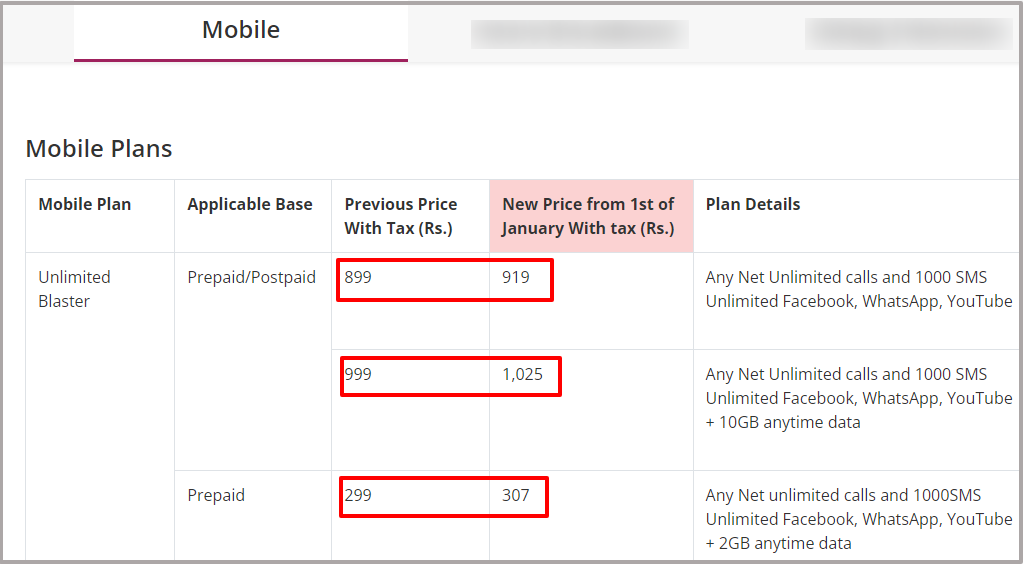

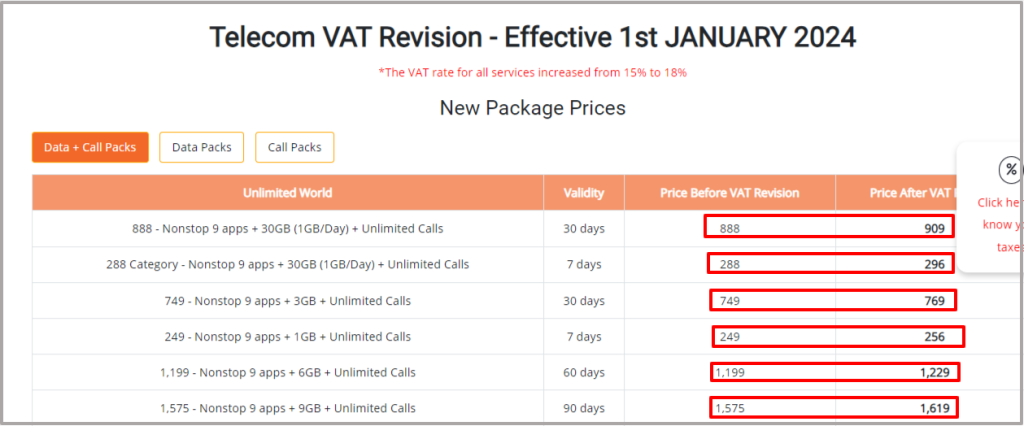

Dialog

Dialog Web Can Be Reached Here

Hutch

Hutch Web Can Be Reached Here.

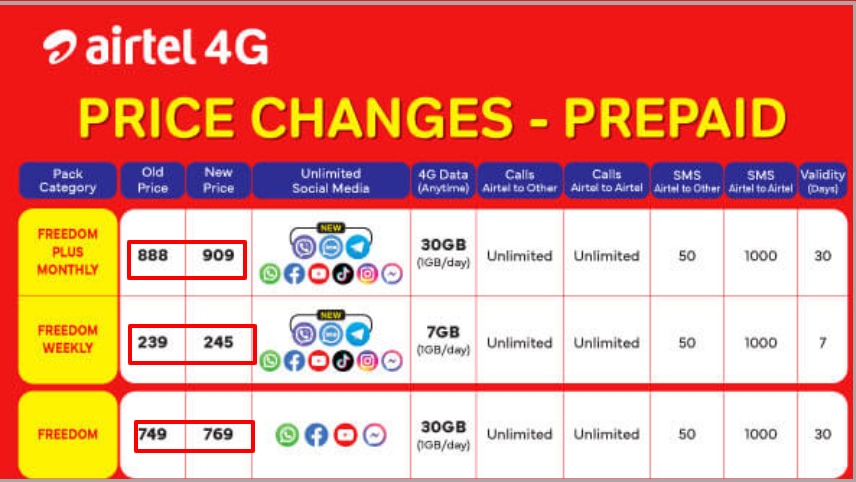

Airtel

Similarly, the price increments pertaining to VAT increments were reflecting an amount corresponding to 3% as seen in the rate revisions published by Mobitel as well.

Accordingly, it’s clear that the above price changes of all telecom providers, related to voice and data packages, are in line with the 3% increment in VAT and not 23%, as mentioned in social media posts.

Television Charges

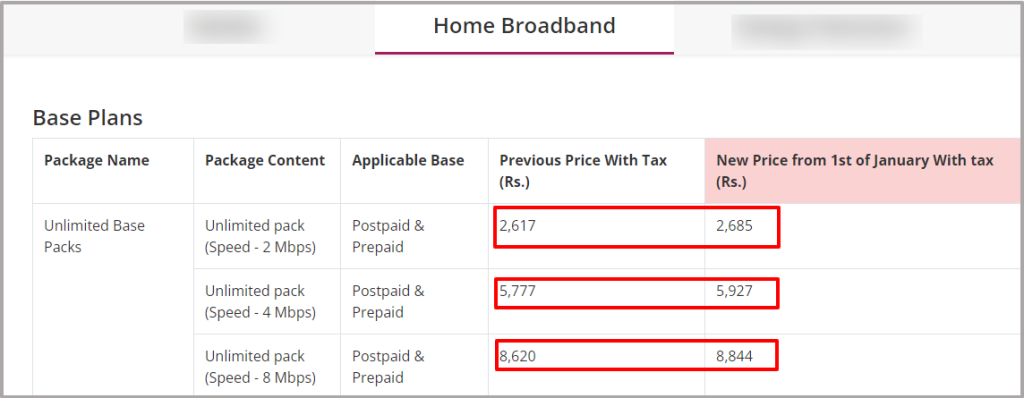

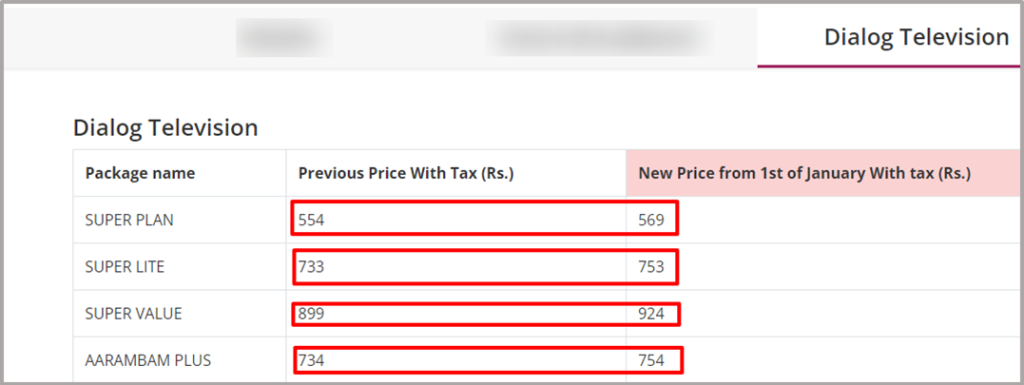

Dialog TV

According to all these price changes, it`s clear that for television packages, the increment of prices is also corresponding to 3% and not 42% as mentioned in social media posts.

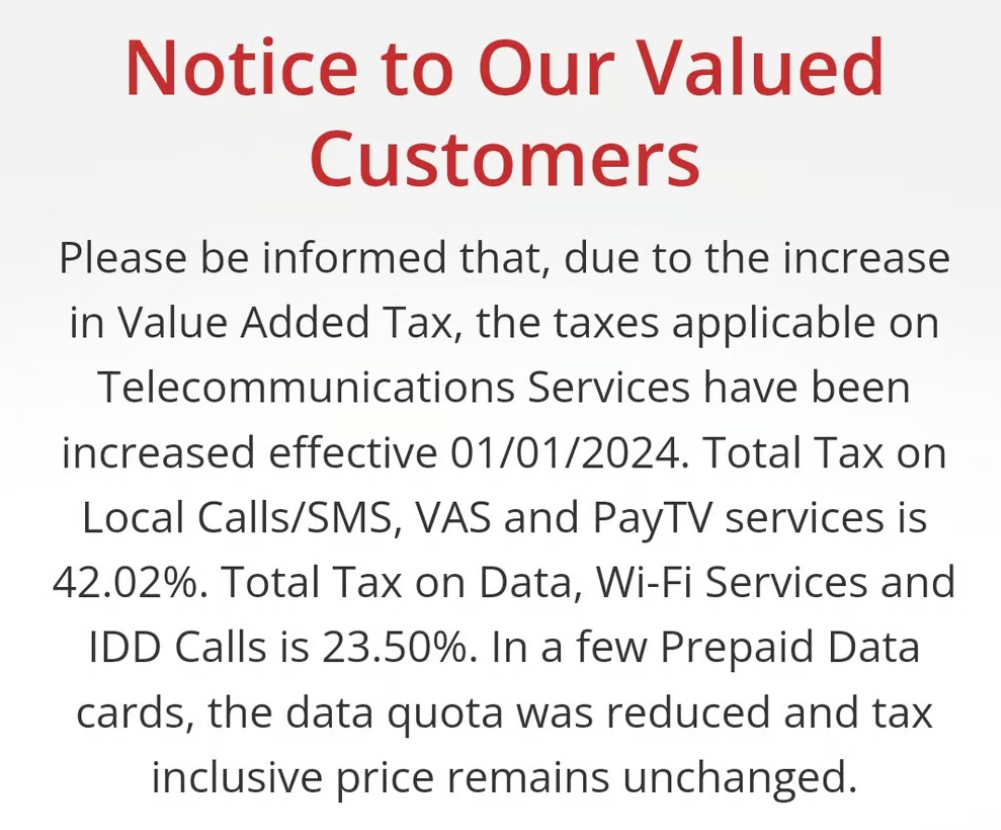

Confusion Caused Due to The Misinterpretation of Communique by Telcos:

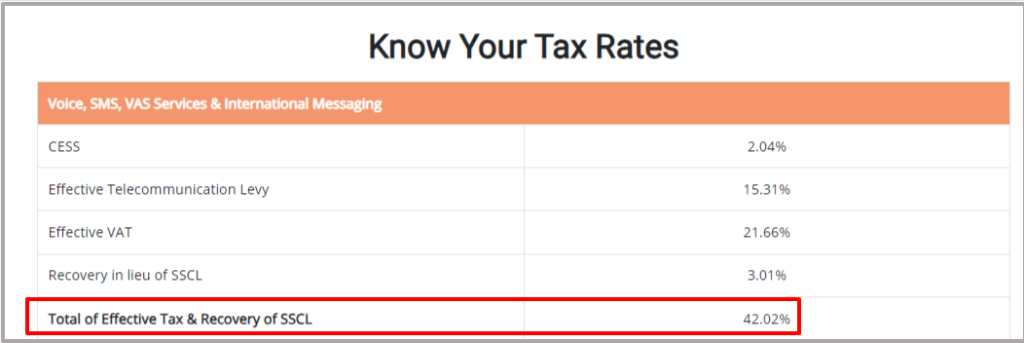

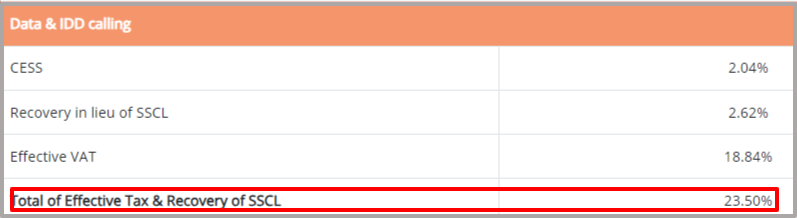

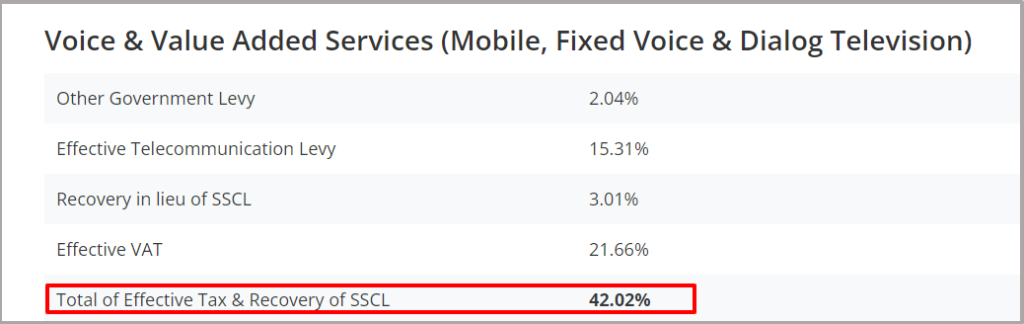

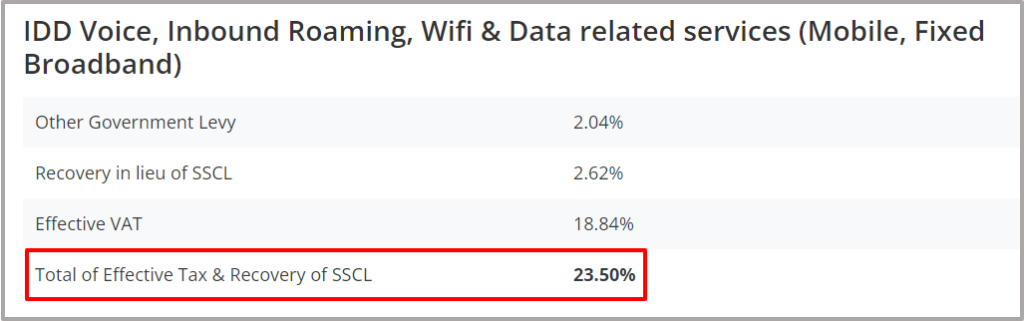

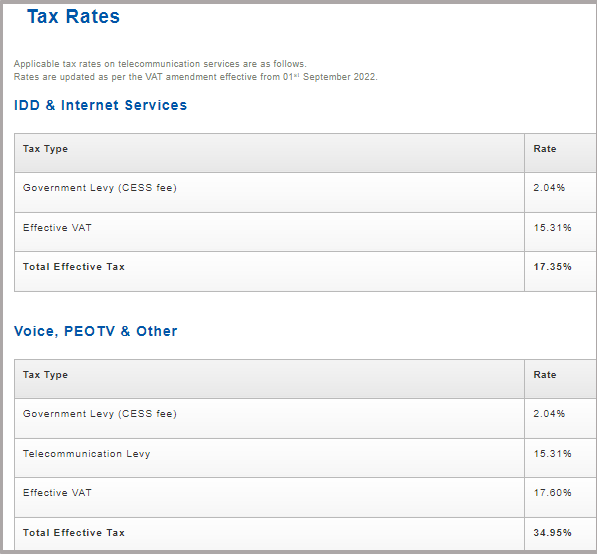

Most of the telecommunication providers, sent out communiques to their customer based by end of 2023, mentioning that as a result of the new VAT increment how the total tax amounts would be effective with effective from 1st of January 2024. Accordingly, as seen in the below message by Dialog, it was communicated that total tax component from Jan 1st onwards on local Call/SMS, VAS and Pay TV would be 42% and total tax on data, wifi services, and IDD would be 23.5%.

But this was misinterpreted by some tax increment only as a result of 15-18% VAT increment, which is not the case.

We looked at what were the contributing elements to the total tax on mobile services as published by the telcos.

Total Tax Percentage On Voice, Data and Television Charges

Hutch presents total percentage from below table.

As per this total tax percentage for Voice, SMS,VAS services now is around 42 % .

As per this total tax percentage for data is around 23 % .

Below are dialog tax calculation tables.

Mobitel website has the total tax percentages before the VAT increment.

Follow us and stay up to date with our latest fact checks.

Facebook | Twitter | Instagram | Google News | TikTok

Conclusion:

The social media claim of a 23% increase in data and voice charges for Sri Lanka’s communication networks and 42% increase television charges, starting January 1, 2024, is misleading. Mobile and Pay TV sectors are subjected to the the 3% VAT increase, effective from 1st of January.

However, the 42% is the total tax components from Jan 1st onwards for services such as local Call/SMS, VAS and Pay TV & and 23% for Data, Wi-Fi services, and IDD. The increased VAT component is included inside these tax components, seen by the breakdown also.

It is crucial to rely on accurate and verifiable information from official sources to avoid the spread of misinformation.

Title:Unsubstantiated False Claims of High Increments in Telecommunication Charges in Sri Lanka Due to VAT

Written By: Kalana KrishanthaResult: Misleading