With the rapid spread of COVID-19 in the country, the government of Sri Lanka has taken steps to provide various forms of relief to various sectors, including banking and financial services. The easing of interest rates subjected to Central Bank restrictions and the extensions to loan repayment periods were some of the concessions provided by local banks.

In the meanwhile, we have all seen banks encouraging consumers to increase card transactions instead of cash, considering the risk of the virus spreading through banknotes in recent times.

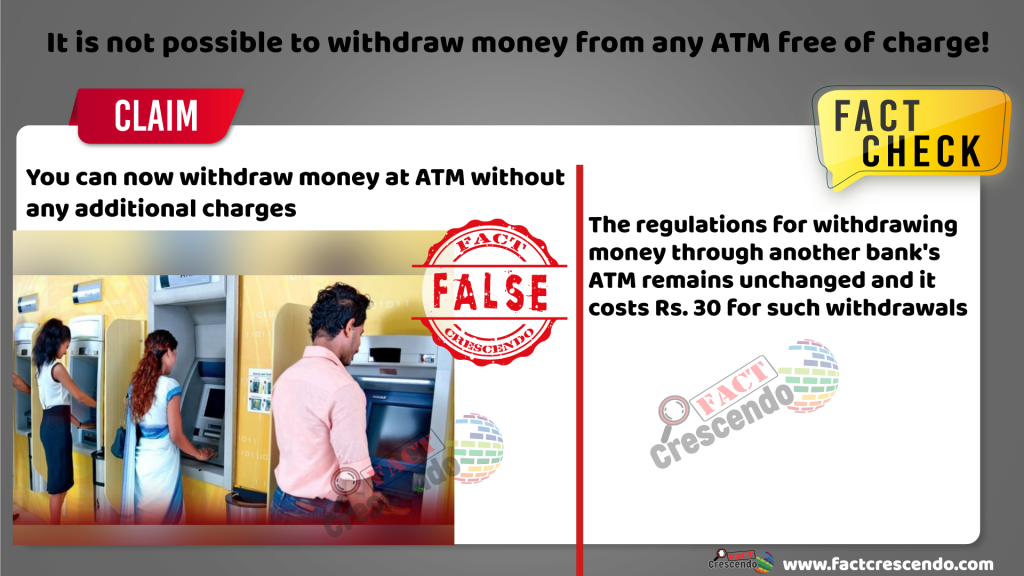

However, what banks did with the aim of minimizing the physical use of money, has been misinterpreted by some as withdrawl from ATMs using card belonging to another bank will be free of charge. Viral posts on social media are spreading these rumors. We can confirm that this news being spread through Facebook is completely untrue.

Viral Claim on Social Media:

Below image, which went viral among social media, users in Sri Lanka claimed that it was now possible for the public to withdraw money using their bankcards at any ATM free of charge.

This same news had been reported on many Facebook pages and profiles as well as websites. We observed that many people had reported this news quoting the Chairman of the Sri Lanka Banks’ Association, Lakshman Silva as can be seen below:

Two local websites Neth News and Kumbio News also reported this information, stating that all banks had facilitated the public to withdraw money through their bankcards without any handling fees due to the prevailing situation in the country.

We decided to inquire further, as to whether such relief was indeed granted.

Fact Check

LankaPay is Sri Lanka’s National Payment Network, operated under the guidance and supervision of the Central Bank, which facilitates all domestic interbank payments. LankaPay is governed by an organization called Lanka Clear. Therefore, we contacted Channa de Silva, CEO of Lanka Clear to get a clarification on above viral claims.

He made it clear that all charges related to ATM withdrawals are carried out from respective banks and that the banks have not decided to waive off that fee yet. However, Mr. Silva added that there are plans to reduce the present the fee of Rs. 30 for withdrawals pertaining to other bank ATMs to Rs. 15 in the future.

FAQ section of the Lanka Clear website clearly indicated that the charge for using another bank ATM is Rs. 30, as seen below.

Many of those who had responded to above viral claims of fee waiver for other bank ATM withdrawals had commented in disagreement along with online transaction proof as seen here. Those comments also pointed out that Rs.30 is the norm for other bank ATM charge.

Mr. Channa de Silva further stated that a misunderstanding of the statement made by the Chairman of the Sri Lanka Banks’ Association, Lakshman Silva had led to the creation of these false claims.

We also inquired about this from the Central Bank of Sri Lanka and they clarified that that no such decision to waive off other bank ATM fee had been made.

We tried out this and noticed Rs.30 is still being deducted from withdrawals done from another bank ATM. In addition, Rs.5 was deducted from own bank transactions, which we tested on a couple of local bank withdrawals.

The interview that led to the creation of the fake news:

We found out that Neth FM Radio’s Balumgala programme had recently broadcast a live interview with Lakshman Silva, Chairman of the Sri Lanka Banks’ Association.

Towards the latter part of the discussion, the announcer clearly questions Mr. Silva about the extra costs related to withdrawing money from ATMs and the fees applicable to obtaining loans. Yet, Mr. Lakshman Silva answers only regarding the relaxation of fees applicable to loan schemes under the Covid-19 situation.

For more information, refer to that conversation below. (Beginning at the 47th minute)

Although the discussion never mentions that all fees are waived when withdrawing money from any ATM, when the radio announcer clearly asks a question relating to the issue of higher handling fees faced by the public for ATM transactions other than their own bank and about issues with debt moratorium, Mr. Silva replies about measures relating to debt moratorium only. Therefore, it seems many have assumed from that reply that the fee is waived off for withdrawing money from all ATMs.

Lakshman Silva, Chairman of the Sri Lanka Banks’ Association is also the CEO of DFCC bank. We contacted the bank to get the version on the above interview and were informed that Mr. Silva had discussed about debt moratorium concessions and not about ATM withdrawal fee waivers.

Here are the official Central Bank of Sri Lanka announcements relating to Debt Moratorium due to Covid-19 conditions.

“A statement was issued with a series of instructions to financial institutions at the request of the government to exempt senior citizens from surcharges payable at banks’ ATMs” said an Ada Derana news item from June 2020, under the title “Central Bank’s efforts during the pandemic and its relief and benefits to the public”.

Conclusion

In view of the above, we can confirm that viral social media posts claiming that public could withdraw money without any additional charge from any ATM is false. The regulations for withdrawing money through another bank’s ATM remains unchanged and it costs Rs. 30 for such withdrawals. This misleading news spread based on misinterpretation a statement made by Lakshman Silva, Chairman of the Sri Lanka Banks’ Association during a live radio interview recently.